Shape

your wealth

Together, we build the future of your wealth.

Our levels of service

Discretionary mandate

Our discretionary mandate offers you the full benefit of our active management and fund selection expertise, Tailored to your unique profile, our bespoke solutions ensure that your portfolio reflects your specific objectives and risk tolerance.

Advisory mandate

Our advisory mandate (a non-discretionary mandate) puts you in control while benefitting from our investment expertise. We actively suggest tailored strategies and investment ideas based on your profile, we support you every step of the way.

Consolidation

Good decisions are always based on a clear vision of the situation.

If you have several investment portfolios held at different institutions, you probably face the challenge of knowing exactly which is your overall exposure to asset classes, currencies, markets, or issuers.

Without an accurate view of your global assets and risk metrics, it is impossible to take appropriate decisions or to assess the real results achieved by your investments.

This is why we offer our global consolidation and reporting services.

INVESTMENT PROFILES

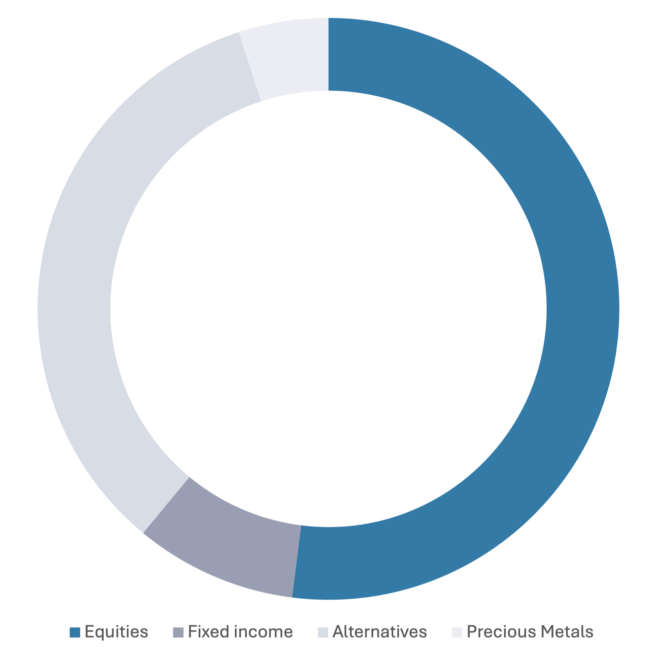

Depending on whether you place greater or lesser emphasis on capital preservation or growth, you can choose from different profiles, which can be adapted to your specific needs.

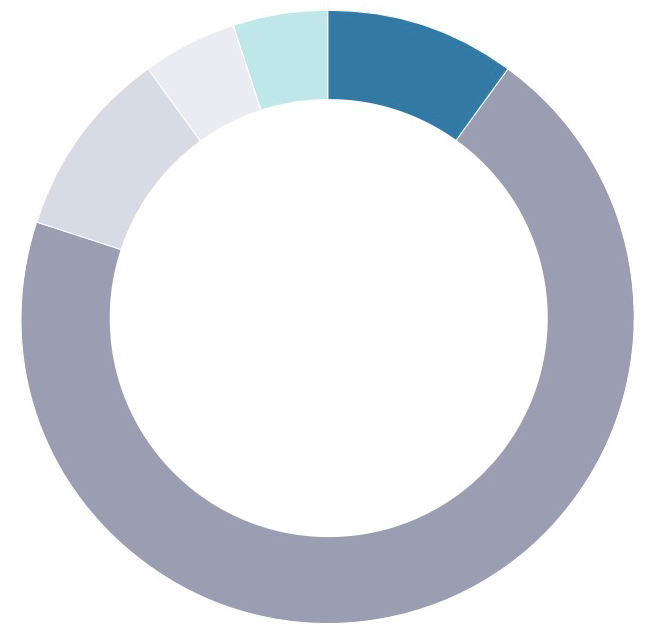

Conservative

Essentially focused on capital stability and income generation, this profile invests mainly in fixed income and low volatility investments.

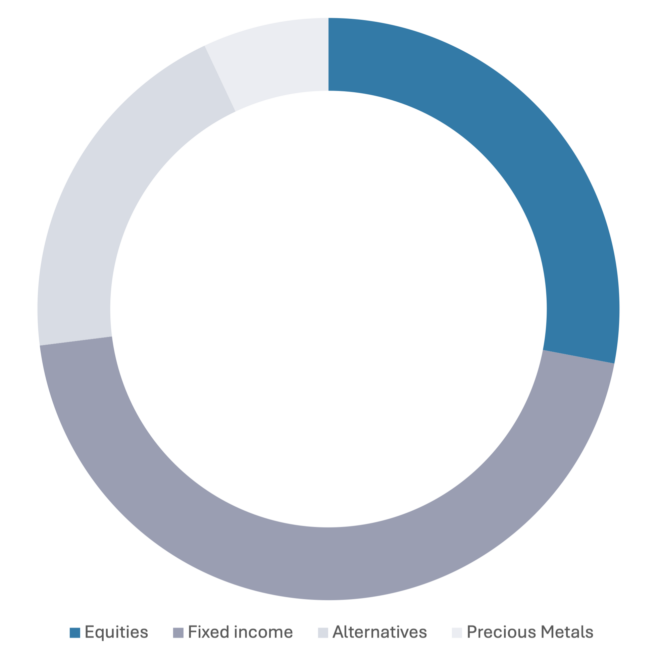

Balanced

Aimed at achieving a balance between stability and capital growth, this profile is more broadly diversified between fixed income, equities and alternative investments.

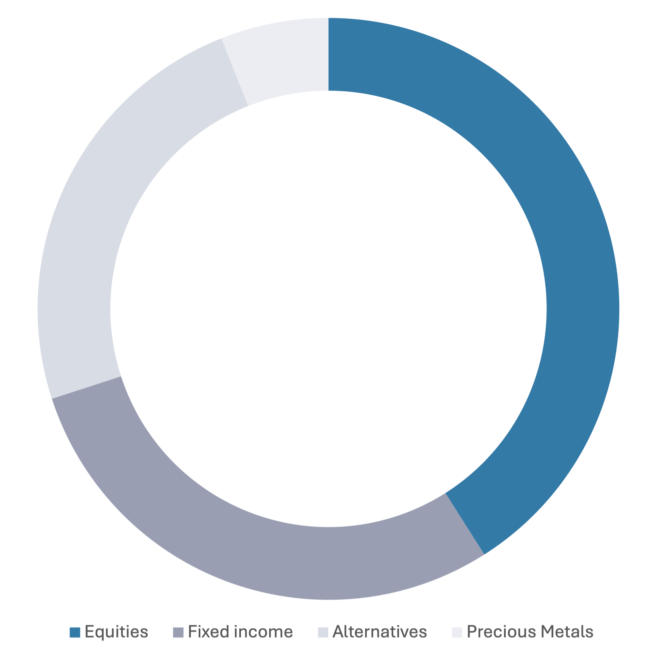

Growth

The aim of this profile is to achieve a high return over the long term. The portfolio is invested mainly in equities and directional strategies, supplemented by bonds and alternative products.

WEALTH MANAGEMENT AT NS PARTNERS

It’s all about you.

Bespoke solutions

Thanks to our ability to really understand your needs, the agility afforded by our human scale and our recognised expertise, we can suggest and implement solutions that are tailor-made just for you.

Alignment of interests

Our solutions are built on the principle of alignment of interests through co-investments and performance-linked fees, ensuring that we only succeed when you do.

Best talent for you

For over 60 years, it is in the DNA of our seasoned investment team to actively manage your portfolio.

Performance, performance!

We achieve your performance objectives being long term investors, not short-term traders. This is how we shape your wealth.

Our clients

You are unique. You rightly expect the highest standards of service, individual attention, and sophisticated investment strategies delivering superior results.

Individuals

- Discretionary mandates

- Advisory mandates

- Dedicated mandates

- Fund management

Families

- Discretionary mandates

- Advisory mandates

- Dedicated funds

- Fund Management